Our professionals come from both the technical and financial sides of the energy investment banking industry. Since the late 1970s, our senior advisors have prospered in every phase of the last four business cycles and our reputation ensures that our clients benefit from the decades of goodwill we have created.

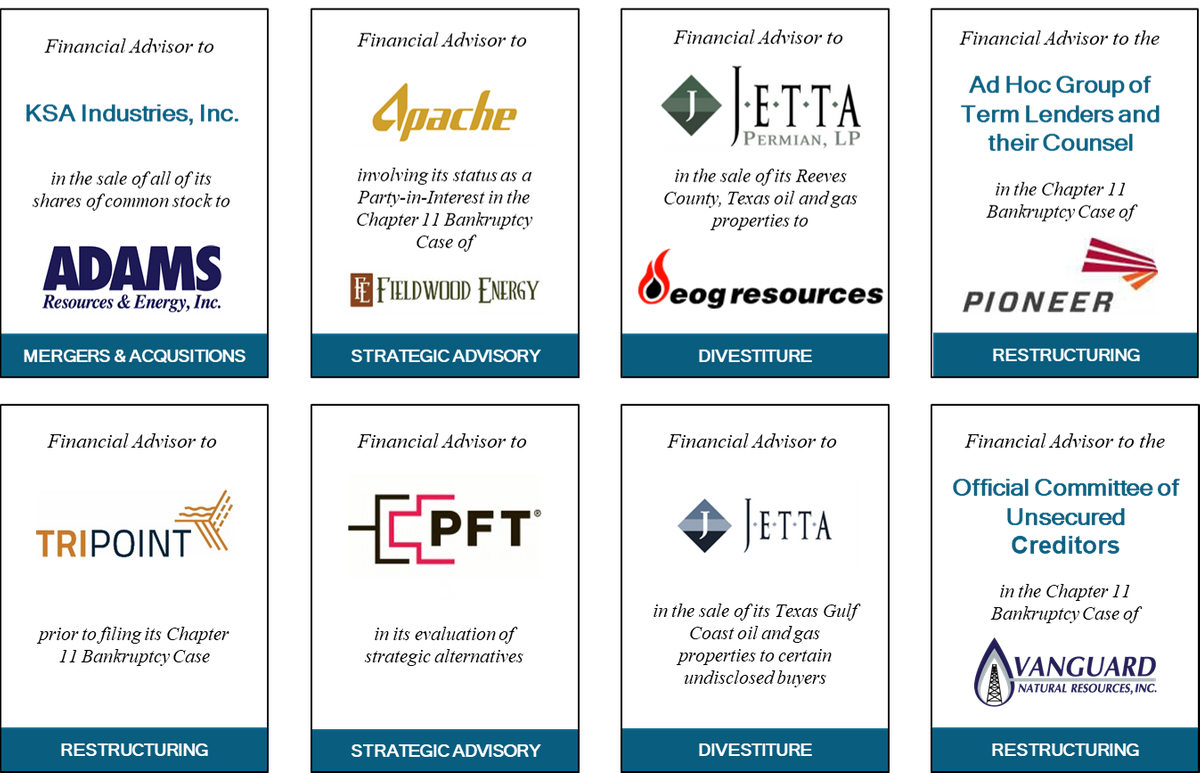

Recent Notable Transactions

All Transactions

- 2023 - PFT

- Advisory Concerning Evaluation of Strategic Alternatives

- 2022 - KSA Industries, Inc. - $60,000,000

- Sale of Adams Resources & Energy, Inc. Common Stock in Negotiated Share Repurchase

- 2021 - Jetta Permian

- Sale of Reeves County oil and gas assets to EOG Resources (value not disclosed)

- 2021 - Apache Corporation

- Financial Advisor in the Chapter 11 Bankruptcy Cases of Fieldwood Energy LLC, et al

- 2020 - MTE Holdings LLC

- Financial Advisor to Debtor in Chapter 11 Bankruptcy Case

- 2020 - Tri-Point LLC

- Financial Advisor to Debtor prior to Chapter 11 Bankruptcy Filing

- 2019 - Undisclosed Company

- Financial Advisor to Undisclosed Party-In-Interest to Sanchez Energy

- 2019 - Jetta Operating Company

- Sale of Certain Texas Gulf Coast Assets to Undisclosed Buyer

- 2019 - Vanguard Natural Resources

- Financial Advisor to Official Committee of Unsecured Creditors in Chapter 11 Bankruptcy Case

- 2019 - Bravo Natural Resources

- Financial Advisor in Connection with Identifying and Evaluating Acquisition Opportunities

- 2018 - Undisclosed Company

- Special Financial Advisor to the Litigation Support Group Representing the First Lien Senior Secured Lenders in an Out-of-Court Restructuring Negotiation

- 2018 - Apache Corporation

- Financial Advisor to Apache Corporation in the Chapter 11 Bankruptcy Cases of Fieldwood Energy LLC, et al

- 2017 - East Cameron Operating Company

- Financial Advisor on the Purchase of Senior Debt Securities and DIP Loan Funding in Support of East Cameron Operating Company's Reorganization in Chapter 11 Bankruptcy

- 2017 - Linn Energy, LLC

- Special Financial Advisor to the Litigation Support Group Representing the First Lien Senior Secured Lenders in the Chapter 11 Bankruptcy Cases of Linn Energy, LLC

- 2017 - Berry Petroleum, LLC

- Special Financial Advisor to the Litigation Support Group Representing the First Lien Senior Secured Lenders in the Chapter 11 Bankruptcy Cases of Berry Petroleum, LLC

- 2017 - Badlands Energy, Inc.

- Sale of Oil and Gas Properties Pursuant to Section 363 of U.S. Bankruptcy Code

- 2017 - Northstar Offshore Group

- Sale of Oil and Gas Properties Pursuant to Section 363 of U.S. Bankruptcy Code

- 2012 - 2017 - Monterey Energy LLC

- Served as Financial Advisor on Corporate Matters

- 2016 & 2017 - Undisclosed Company

- Financial Advisor to Creditors in Chapter 11 Bankruptcy Cases

- 2016 - Caza Oil and Gas, Inc.

- Formal Valuation to the Special Committee Regarding Going-Private Transaction

- 2016 - Energy XXI Ltd. - $2,860,000,000

- Financial Advisor to Independent Directors of EXXI's Subsidiaries in Chapter 11 Bankruptcy Cases

- 2016 - Linc USA GP

- Sale of Oil and Gas Properties Pursuant to Section 363 of U.S. Bankruptcy Code

- 2016 - Primexx Energy Partners, Ltd. - $430,000,000

- Private Placement of Senior Preferred Equity, Replacement of Second Lien Secured Term Loan and Equity Commitment to Fund a Mineral Royalty Trust SPV

- 2016 - RAAM Global Energy

- Sale of Oil and Gas Properties Pursuant to Section 363 of U.S. Bankruptcy Code

- 2016 - Undisclosed Private Company

- Financial Advisor in Connection with Identifying and Evaluating Strategic Alternatives

- 2016 - Undisclosed Private Company

- Financial Advisor to Family Office in Connection with a Chapter 11 363 Sale of Assets

- 2015 - Dune Energy, Inc.

- Sale of Oil and Gas Properties pursuant to section 363 of U.S. Bankruptcy Code

- 2015 - Longview Energy Company

- Sale of Certain California Properties to White Knight Production LLC

- 2015 - Primexx Energy Partners, Ltd. - $125,000,000

- Private Placement of Second Lien Secured Term Loan

- 2015 - Undisclosed Permian Basin Company

- Restructuring of Second Lien Term Loan

- 2015 - Undisclosed Private Company

- Financial Advisor to Company to Raise New Equity to De-Lever and Develop its Oil & Gas Assets

- 2015 - Undisclosed Private Company

- Served Board of Directors to Advise Company on Value for Purposes of New Equity Options Issuance

- 2012 - 2014 - Ultra Tech Frac Services, LLC

- Served as Financial Advisor on Corporate Matters

- 2014 - Undisclosed Private Company

- Served Board of Directors to Advise Company on Value for Purposes of New Equity Options Issuance

- 2013 - Ultra Tech Frac Services, LLC

- Sale to Keane Group

- 2013 - Undisclosed Permian Basin Company - $110,000,000

- Private Placement of First Lien ($40,000,000), Second Lien Term Loan with Warrants ($60,000,000) and Follow-On Equity ($10,000,000)

- 2013 - Undisclosed Private Company

- Financial Advisor to the Advisory Board of a Private Company in Connection with the Sale of its Assets to Constellation Energy Partners

- 2013 - Undisclosed Private Company

- Served Board of Directors to Advise Company on Value for Purposes of New Equity Options Issuance

- 2013 - Undisclosed Private Company

- Advisor to Board of Directors to Provide Certain Financial Advisory Services

- 2012 - Dune Energy, Inc.

- Strategic Advisory & Fairness Opinions in Connection with Identifying and Evaluating Strategic and Financial Alternatives

- 2012 - Monterey Energy - $6,400,000

- Private Placement

- 2011 - Cinco Resources

- Fairness Opinion to Special Committee Regarding Merger with Cima Resources

- 2011 - Cortez Resources

- Sale of Certain Eagle Ford Shale Assets to Carrizo Oil & Gas

- 2011 - Cortez Resources

- Sale of Certain Eagle Ford Shale Assets to Comstock Resources

- 2011 - Cortez Resources

- Sale of Certain Eagle Ford Shale Assets to Undisclosed Buyer

- 2011 - Cortez Resources and Sierra Buckeye

- Sale of Certain Eagle Ford Shale Assets to Chesapeake Energy

- 2011 - Cortez Resources and Sierra Resources, LLC

- Sale of Certain Eagle Ford Shale Assets to Riley-Huff Energy Group, LLC

- 2011 - The Diocese of Wheeling-Charleston

- Sale of Leases for West Texas Mineral Rights

- 2011 - Dune Energy, Inc.

- Fairness Opinion Regarding Debt Exchange Offer

- 2011 - GHK Exploration (Texas) LLC

- Sale of Eagle Ford Shale Assets to Marathon Oil Corporation

- 2011 - Hi-Crush Proppants LLC - $70,000,000

- Private Placement

- 2011 - LasRosas Capital LLC & RGW Interests LLC

- Formation of Eagle Ford Shale Participation Agreement with Liberty Energy

- 2011 - MatlinPatterson

- Acquisition of a Controlling Stake in Stone Mountain Resources

- 2011 - Petsec Energy - $29,100,000

- Out of Court Restructuring

- 2011 - Storm Cat Energy

- Financial Advisor to Debtor in Chapter 11 Bankruptcy Case

- 2011 - Ultra Tech Frac Services, LLC - $21,250,000

- Private Placement

- 2010 - Bigler LP (Bigler Chemical, LP)

- Sale of Basic Liquid Inorganic and Organic Chemicals Marketing Subsidiary to Shieve Chemical Company Pursuant to Section 363 of U.S. Bankruptcy Code

- 2010 - Bigler LP (Bigler Land LLC)

- Sale to Intercontinental Terminals Company Pursuant to Section 363 of U.S. Bankruptcy Code

- 2010 - Bigler LP (Bigler Specialty Oils)

- Sale of Technical Mineral Oils, FDA White Oils, and High Purity Hydrocarbon Solvents Marketing subsidiary to Resolute Oil, LLC Pursuant to Section 363 of U.S. Bankruptcy Code

- 2010 - Bigler LP (Bigler Terminals, LP & Bigler Petrochemical, LP)

- Sale of its Tank Leasing & Logistics Services and Isobutylene Manufacturing subsidiaries to Enterprise Products Operating LLC Pursuant to Section 363 of U.S. Bankruptcy Code

- 2010 - Clearwater Natural Resources

- Sale of Substantially All Assets as Well as the Assumption of All Reclamation Liabilities by International Resource Partners LP as Part of a Chapter 11 Plan of Reorganization

- 2010 - Cortez Resources

- Sale of Certain Eagle Ford Shale Assets to Penn Virginia Oil & Gas, L.P.

- 2010 - Edge Petroleum Corporation - $260,000,000

- Sale of All Subsidiaries and Operations to Mariner Energy Pursuant to the U.S. Bankruptcy Code

- 2010 - Patriot Resources Partners LLC

- Sale of Oil and Gas Properties to Linn Energy and Rising Star Energy

- 2010 - Saratoga Resources (Harvest O&G)

- Financial Advisor to Secured Creditor, Wayzata, in Chapter 11 Bankruptcy Case

- 2010 - Undisclosed Private Company

- Financial Advisor to Debtor in Connection with a Chapter 11 Bankruptcy Case

- 2010 - Undisclosed Private Company

- Served Board of Directors to Advise Company on Value for Purposes of New Equity Options Issuance

- 2009 - Beryl Oil and Gas LP

- Financial Advisor to First Lien Creditors in sale of Beryl to Dynamic Offshore Resources

- 2009 - Energy Partners Ltd. - $520,000,000

- Reorganization Under Chapter 11 Bankruptcy Code Pursuant to Debt-for-Equity Exchange and Exit Financing

- 2009 - Foothills Resources

- Financial Advisor to Debtor Prior to Chapter 11 Filing

- 2009 - Quicksilver Gas Services LP - $87,100,000

- Fairness Opinion to Conflicts Committee of Board of Directors on its Drop-Down Acquisition of Alliance Midstream Assets from Quicksilver Resources

- 2009 - Undisclosed Company

- Financial Advisor to Debtor in Connection with a Chapter 11 Bankruptcy Case

- 2008 - Mark West Energy Partners - $3,000,000,000

- Merger with Mark West Hydrocarbon, Inc.

- 2008 - Royal Offshore, LLC - $350,000,000

- Private Placement with Encap Investments and Avista Capital to Pursue Gulf of Mexico Exploration Program

- 2008 - T-Rex Companies

- Sale of All Permian Basin Oil & Gas Assets to Enervest Energy Institutional Fund XI

- 2007 - Patriot Resources Partners LLC

- Private Placement

- 2006 - Chief Holdings LLC - $480,000,000

- Sale of Midstream Assets to Crosstex Energy LLP

- 2006 - Chief Oil and Gas - $2,200,000,000

- Sale of Company to Devon Energy

- 2006 - Halliburton

- Private Placement for Formation of Red Technology Alliance

- 2006 - Star Gas Partners, L.P. - $323,000,000

- $58,000,000 Equity Investment by Yorktown Energy Partners and the Repurchase and Conversion into Equity of a Portion of its $265,000,000 of Senior Notes

- 2006 - Star Gas Partners, L.P.

- Financial Advisor to the Ad Hoc Committee of Noteholders in Out-of-Court Financial Restructuring

- 2006 - Wapiti

- Private Placement

- 2005 - Latigo Petroleum - $750,000,000

- Company Sale to Pogo Producing

- 2005 - Southern California Power Producers Authority - $300,000,000

- Purchase of Wyoming Producing Gas Properties from Anschutz Pinedale Corporation

- 2005 - USX Exploration - $350,000,000

- Company sale to Noble Energy

- 2004 - Bravo Natural Resources - $335,000,000

- Sale of Mid-Con Assets to Chesapeake Energy

- 2004 - Encana Corporation - $2,000,000,000

- Sale of Deepwater Gulf of Mexico Assets to Statoil

- 2004 - EnRe L.P.

- Financial Advisor to Debtor in Chapter 11 Proceedings, Resulting in Sale of Certain Assets

- 2004 - First International Oil Company - $160,000,000

- Fairness Opinion on Sale of Kazakhstan assets to Sinopec

- 2004 - Houston Exploration

- “KeySpan Exchange Transactions” where HE Contributed Subsidiary Seneca-Upshur Petroleum Inc. Assets and $389,000,000 Cash in Exchange for 10,800,000 Shares of HE Common Stock Owned by KeySpan

- 2004 - Mission Resources Corporation - $155,000,000

- Private Offering of a Second Lien Term Loan and 9 7/8% Senior Notes due 2011

- 2004 - Patina Oil & Gas - $3,400,000,000

- Merger with Noble Energy

- 2004 - Plains Resources - $466,700,000

- Merger with Vulcan Capital Management

- 2003 - Classic Communications Inc.

- Financial Advisor to the Official Committee of Unsecured Creditors in Chapter 11 Proceedings

- 2003 - El Paso E&P - $752,000,000

- Sale of Assets in Gulf of Mexico, South Texas, ArkLaTex, MidCon and the Rockies

- 2003 - MBIA - $500,000,000

- Advisory Assignment in Regard to Bonds Issued to Westar Insured by MBIA

- 2003 - Mission Resources Corporation - $97,600,000

- Debt Restructuring

- 2003 - Moll Industries Inc.

- Financial Advisor to the Official Committee of Unsecured Creditors in Chapter 11 Proceedings

- 2003 - Panaco Inc.

- Financial Advisor to the Official Committee of Unsecured Creditors in this Chapter 11 Bankruptcy Case

- 2003 - Sacramento Municipal Utility District

- Purchase of Gas Assets from El Paso Corporation

- 2003 - Texas Petrochemicals

- Financial Advisor to the Debtor in this Chapter 11 Bankruptcy Case

- 2002 - Bravo Natural Resources - $119,000,000

- Sale of Mid-Con Assets to Patina Oil & Gas

- 2002 - Coho Energy

- Financial Advisor to the Official Committee of Unsecured Creditors in this Chapter 11 Bankruptcy Case

- 2002 - EOTT Energy Partners

- Financial Advisor to the Official Committee of Unsecured Creditors in this Chapter 11 Bankruptcy Case

- 2002 - Friede Goldman Halter, Inc.

- Financial Advisor to the Official Committee of Unsecured Creditors in this Chapter 11 Bankruptcy Case

- 2002 - NIKOIL

- Fairness Opinion on Minority Takeout of Lukoil Baltija Shares

- 2002 - Pure Resources - $1,800,000,000

- Merger with Unocal Corporation

- 2001 - Agrifos Fertilizer

- Financial Advisor to the Debtor in Chapter 11 Bankruptcy Case.

- 2001 - Barrett Resources Corporation - $2,900,000,000

- Merger with the Williams Companies

- 2001 - Cody Company - $230,000,000

- Merger with Cabot Oil & Gas

- 2001 - First Wave Marine

- Financial Advisor to the Official Committee of Unsecured Creditors in this Chapter 11 Bankruptcy Case

- 2001 - Hallwood Energy Corporation - $268,000,000

- Merger with Pure Resources, Inc.

- 2001 - International Paper Company - $300,000,000

- Conveyance of its Subsidiary IP Petroleum Company, Inc. to Pure Resources, Inc.

- 2001 - Kingdom of Saudi Arabia

- Advisory Assignment to Design Integrated Natural Gas Projects for Direct Foreign Investment

- 2000 - Collins & Ware, Inc. - $68,500,000

- Asset Sale to Apache Corporation

- 2000 - Costilla Energy - $133,300,000

- Advisor to Debtor in Chapter 11 363 Sale of Certain Assets to Louis Dreyfus Natural Gas

- 2000 - Crescendo Resources, L.P.

- Sale of Mid-Con Assets to Apache Corporation

- 2000 - Forcenergy Inc.

- Financial Advisor to the Official Committee of Unsecured Creditors in this Chapter 11 Bankruptcy Case

- 2000 - Forcenergy Inc. - $936,000,000

- Merger with Forest Oil Corporation

- 2000 - Gothic Energy

- Financial Advisor to the Ad Hoc Committee of Noteholders in Out-of-Court Financial Restructuring

- 2000 - KCS Energy

- Financial Advisor to the Official Committee of Unsecured Creditors in this Chapter 11 Bankruptcy Case

- 2000 - Southern Mineral Corporation

- Financial Advisor to the Debtor in this Chapter 11 Bankruptcy Case

- 2000 - Texaco Inc. - $450,000,000

- Asset Sale to Various Companies

- 2000 - Vastar Resources, Inc. - $9,061,000,000

- Merger into Atlantic Richfield Company / BP Amoco

- 2000 - Southern Mineral Corporation - $80,000,000

- Merger with PetroCorp Inc.

- 1999 - Atlantic Richfield Company - $100,000,000

- Divestiture of ARCO Long Beach, Inc. to Occidental Petroleum Corporation

- 1999 - K N Energy, Inc. - $978,000,000

- Merger with Kinder Morgan Energy, Inc.

- 1999 - Petsec Energy - $68,500,000

- Asset Sale to Apache Corporation

- 1999 - Snyder Oil Corporation - $600,000,000

- Merger with Santa Fe Energy Corporation

- 1999 - Titan Exploration, Inc. - $217,400,000

- Merger with Unocal’s Permian Basin Business Unit to form Pure Energy Resources, Inc.

- 1999 - Titan Exploration, Inc. - $71,300,000

- Sale of Gulf of Mexico assets to Coastal Oil & Gas Corporation

- 1999 - The Wiser Oil Company - $28,000,000

- Divestiture of certain Appalachian Properties to Columbia Natural Resources

- 1999 - The Wiser Oil Company - $25,000,000

- Fairness Opinion Regarding Private Placement of Convertible Preferred Stock

- 1998 - Amerac Energy - $24,000,000

- Sale of the Company to Southern Minerals

- 1998 - Domain Energy - $250,000,000

- Sale to Range Resources

- 1998 - Duer Wagner & Company - $40,500,000

- Asset Sale to Samson Resources

- 1998 - H S Resources - $155,000,000

- Sale of Mid-Con Properties to Questar Corporation

- 1998 - Hugoton Energy Corporation - $380,000,000

- Merger with Chesapeake Energy Corporation

- 1998 - Institutional Investors - $38,000,000

- Sale of Oil and Gas Properties to Ocean Energy, Inc.

- 1998 - John Hancock Mutual Life Insurance - $40,500,000

- Divestiture of Certain Oil and Gas Assets to Ocean Energy, Inc.

- 1998 - Union Texas Petroleum Holdings - $3,539,000,000

- Merger into Atlantic Richfield Company

- 1998 - Vastar Resources, Inc. - $470,000,000

- Acquisition of Western Midway Company from Atlantic Richfield Company in three-company transaction involving Vastar, ARCO, and Mobil

- 1997 - Amoco Production Company - $1,000,000,000

- Formation of a Joint Venture with Maxus Energy Corporation

- 1997 - Coda Energy - $334,000,000

- Merger with Belco Oil and Gas

- 1997 - ConVest Energy Corporation/Edisto Resources Corporation - $172,000,000

- Merger with Forcenergy Inc.

- 1997 - Department of Energy - $3,650,000,000

- Asset Sale of Elk Hills to Occidental Petroleum

- 1997 - Institutional Investors

- Sale of Gulf of Mexico and Permian Assets to Wynn-Crosby Energy, Inc.

- 1997 - Institutional Investors - $29,000,000

- Sale of Gulf Coast and Mid-Con Assets to Domain Energy Corporation

- 1997 - Institutional Investors - $35,000,000

- Sale of Mid-Con and Rocky Mountain Assets to UMC Petroleum Corporation

- 1997 - Monterey Resources - $106,000,000

- Acquisition of McFarland Energy

- 1997 - Republic Gas Partners L.L.C. - $29,500,000

- Merger with MidCoast Energy Resources, Inc.

- 1997 - Santa Fe Energy Corporation - $854,000,000

- Spin-Off of Monterey Resources

- 1997 - Torch Energy Advisors Inc. Institutional Investors - $210,000,000

- Sale of Their Respective Interests in Certain Oil & Gas Partnership Programs to Bellwether Exploration Company

- 1997 - Vessels Energy, Inc. - $85,000,000

- Sale of Its D-J Basin Assets to North American Resources Company

- 1997 - Western Mining Corporation - $270,000,000

- Sale of Its U.S. Subsidiary, Greenhill Petroleum Corporation, to MESA Inc.

- 1996 - Amerac Energy - $6,000,000

- Private Placement of Common Stock with Warrants and Exploitation Program

- 1996 - Bannon Energy Inc. - $35,900,000

- Sale of Company Assets to Lomak Petroleum, Inc.

- 1996 - Basin Exploration, Inc. - $123,500,000

- Sale of D-J Assets to HS Resources, Inc.

- 1996 - Edisto Resources - $50,000,000

- Sale of Gas Marketing Assets

- 1996 - Enron Corporation - $200,000,000

- Public Offering of 8.30% Trust Originated Preferred Securities (“TOPrS”)

- 1996 - Global Natural Resource Inc. - $531,000,000

- Merger with Seagull Energy Corporation

- 1996 - Gulfstream Resources, Inc. - $77,000,000

- Sale of Stock to Burlington Resources, Inc.

- 1996 - Marsh Operating Company

- Sale of Acreage Properties to Anadarko Petroleum Corporation

- 1996 - Marsh Operating Company - $26,100,000

- Sale of Oil & Gas Properties to Seagull Energy Corporation

- 1996 - The Phoenix Resource Companies, Inc. - $406,000,000

- Merger with Apache Corporation

- 1996 - PMC Reserve Acquisition Company

- Sale of Its Oil & Gas Interests in Tiger Field, Mississippi to Apache Corp.

- 1996 - PMC Reserve Acquisition Company - $119,700,000

- Sale of Oil & Gas Properties to Questar Corporation

- 1996 - Reunion Resources Company - $11,600,000

- Sale of Oil & Gas Properties to Tribo Petroleum Corporation

- 1996 - Sheffield Exploration

- Merger with TransMontaigne Oil Company

- 1996 - Shell Western E&P

- Sale of Certain Gulf Coast Assets

- 1996 - Tenneco Energy, Enron Gas Gathering, Inc., and Dauphin Island Gathering Company, L.P.

- Sale of Their Respective Interests in Dauphin Island Gathering Partners to MCN Investment Corporation

- 1995 - Barrett Resources Corporation - $321,500,000

- Merger with Plains Petroleum Company

- 1995 - Consolidated Oil & Gas, Inc. - $120,200,000

- Merger with Hugoton Energy Corporation

- 1995 - ConVest Energy Corporation - $20,100,000

- Fairness Opinion Regarding the Acquisition of Edisto Exploration and Production Company

- 1995 - Equitable Resources, Inc. - $17,300,000

- Sale of Appalachian Gas Properties to EnerVest Management Company and GE Capital

- 1995 - Patrick Petroleum Company - $28,000,000

- Merger with La/Cal Energy Partners into Goodrich Petroleum Corporation

- 1995 - The Prudential Insurance Company of America and Collins & Ware, Inc. - $20,200,000

- Sale of Certain Oil & Gas Properties to Louis Dreyfus Natural Gas Corporation

- 1995 - Reunion Resources Company - $11,600,000

- Sale of 1,450,000 Shares of Common Stock held by Parkdale Holdings Corporation, N.V. to Chatwins Group, Inc.

- 1995 - Snyder Oil Corporation - $60,000,000

- Sale of Wattenberg GTM Facilities to Associated Natural Gas

- 1995 - Snyder Oil Corporation - $18,500,000

- Sale of D-J Basin GTM Facilities

- 1995 - Sun Life of Canada

- Sale of Certain Oil & Gas Properties

- 1994 - Bridge Oil Ltd. - $272,400,000

- Valuation Opinion Regarding the U.S. Oil & Gas Assets of Bridge Oil Ltd. in Response to an Unsolicited Offer from Parker & Parsley

- 1994 - Edisto Resources - $72,000,000

- Fairness Opinion Regarding the Sale of Pipeline and Distribution Assets to Aquila

- 1994 - General Atlantic Resources Corporation - $195,900,000

- Merger with United Meridian

- 1994 - K N Energy, Inc. - $430,270,296

- Merger with American Oil & Gas Corporation

- 1994 - Offshore Energy Development Corporation - $54,000,000

- Sale of Certain Mobile Bay Oil & Gas Properties to SCANA Petroleum Resources

- 1994 - Patrick Petroleum Company - $16,100,000

- Sale of Oil & Gas Properties to Unit Corporation

- 1994 - Petroleum Geo-Services A/S - $72,000,000

- Public Offering of American Depositary Receipts

- 1994 - Pogo Producing Company - $86,000,000

- Public Offering of 5½% Convertible Subordinated Debentures

- 1994 - Santa Fe Energy Corporation - $51,000,000

- Sale of Certain Oil & Gas Properties to Bridge Oil (USA)

- 1994 - Santa Fe Energy Resources, Inc.

- Public Offering of $8.875 Delayed Equity Convertible Securities (“DECS”)

- 1994 - The Wiser Oil Company - $52,000,000

- Acquisition of Canadian Oil & Gas Properties from Eagle Resources, Ltd.

- 1993 - American Exploration Company - $18,000,000

- Divestiture of Certain Canadian Oil and Gas Properties to Equitable Resources

- 1993 - Barrett Resources Corporation - $18,000,000

- Sale of Certain Wattenberg Field Interests to Snyder Oil Corporation

- 1993 - Edisto Resources

- Financial Advisor to Official Committee of Unsecured Creditors in Chapter 11 Bankruptcy Case

- 1993 - Enron Oil & Gas Company - $117,000,000

- Public Offering of Common Stock

- 1993 - Federal Petroleum Corporation - $5,000,000

- Sale to Management

- 1993 - Global Industries Ltd. - $38,000,000

- Initial Public Offering of Common Stock

- 1993 - Highway Pipeline Corporation - $4,000,000

- Sale to Edge Group

- 1993 - Kirby Corporation - $50,000,000

- Standby Underwriter in Redemption of 7¼% Convertible Subordinated Debentures

- 1993 - Kirby Corporation - $24,000,000

- Acquisition of TPT Marine Barge Division of Ashland, Inc.

- 1993 - The Louisiana Land & Exploration Company

- Public Offering of 7.65% Debentures

- 1993 - The Louisiana Land & Exploration Company - $196,000,000

- Public Offering of Common Stock

- 1993 - NERCO, Inc. - $1,200,000,000

- Sale to Kennecott

- 1993 - NICOR Oil & Gas Corporation

- Sale of its Subsidiary, NICOR Exploration and Production Company to SCANA Petroleum Resources, Inc.

- 1993 - Noble Affiliates, Inc. - $152,000,000

- Public Offering of Common Stock

- 1993 - Noble Affiliates, Inc. - $230,000,000

- Public Offering of 4¼% Convertible Subordinated Debentures

- 1993 - Petroleum Geo-Services A/S - $73,000,000

- Public Offering of American Depositary Receipts

- 1993 - Santa Fe Energy Corporation - $48,000,000

- Sale of Certain Oil & Gas Properties to Vintage Petroleum

- 1993 - Sonat Offshore Drilling - $373,000,000

- Initial Public Offering of Common Stock

- 1993 - Star Gas Corporation - $120,000,000

- Sale to Petroleum Heat and Power Co.

- 1993 - Triton Energy - $18,700,000

- Sale of Oil & Gas Properties to Torch Energy Advisors Inc.

- 1993 - The Wiser Oil Company - $58,800,000

- Acquisition of Oil & Gas Properties from Mobil Exploration & Production U.S. Inc.

- 1992 - American Exploration Company

- Acquisition of an Additional Interest in Canadian Conquest Exploration from The Prudential Life Insurance Corporation

- 1992 - Apache Corporation - $75,000,000

- Private Placement of 3.93% Convertible Select Premium Low Interest Trust Securities (“SPLITS”)

- 1992 - Hondo Oil and Gas Company - $140,000,000

- Fairness Opinion Regarding Sale of Substantially all of its Domestic Oil & Gas Properties to Devon Energy Corporation

- 1992 - Maxus Energy Corporation

- Sale of Its Interest in the Alpha Field to Swift Energy Company

- 1992 - NERCO Oil & Gas, Inc.

- Exchange of Certain Oil & Gas Properties with Aquila Energy

- 1992 - NERCO Oil & Gas, Inc. - $32,000,000

- Sale of Its Interest in the Trimble Field to SCANA Petroleum Resources, Inc.

- 1992 - NERCO Oil & Gas, Inc. - $6,800,000

- Sale of Certain Gulf of Mexico Oil & Gas Properties to Nomeco Oil & Gas Company

- 1992 - NICOR Oil & Gas Corporation

- Sale of Certain Gas Gathering Assets to Vessels Oil & Gas Company

- 1992 - NICOR Oil & Gas Corporation

- Sale of Reliance Pipeline Company to Transok, Inc.

- 1992 - Paramount Petroleum

- Sale of Its Exploration Division and Certain Exploration Prospects to Nuevo Energy Company

- 1992 - Santa Fe Energy Resources, Inc. - $126,000,000

- Public Offering Secure Principal Energy Receipts (“SPERS”) of Santa Fe Energy Trust

- 1991 - Apache Corporation

- Divestiture of Certain Oil and Gas Properties to General Atlantic Resources, Inc. and Vessels Oil & Gas Company

- 1991 - Apache Corporation

- Divestiture of Its Interest in the Spindle Gas Plant and the Spindle Field to Associated Natural Gas Corporation

- 1991 - Apache Corporation - $550,000,000

- Acquisition of MW Petroleum Corporation from Amoco Production Company

- 1991 - American Exploration Company - $165,000,000

- Acquisition of Conquest Exploration Company

- 1991 - Cross Timbers Partners, L.P.

- Fairness Opinion Regarding the Roll-up of Five Limited Partnerships into Cross Timbers Oil Company, L.P. and Cross Timbers Royalty Trust

- 1991 - Maxus Energy Corporation - $64,000,000

- Sale of Substantially all of Its Rocky Mountains Oil & Gas Properties to Equitable Resources

- 1991 - Moorco International Inc. - $104,000,000

- Initial Public Offering of Common Stock

- 1991 - Pacific Enterprises Oil Company (USA)

- Sale of Oil & Gas Properties to American Exploration Company

- 1991 - Pacific Enterprises Oil Company (USA)

- Sale of Oil & Gas Properties to Oklahoma-Pacific, Ltd.

- 1991 - Pacific Enterprises Oil Company (USA)

- Sale of Oil & Gas Properties to Sonat Exploration Company

- 1991 - Pacific Enterprises Oil Company - $50,000,000

- Sale of Pacific Enterprises Oil Company (Netherlands) to Petron Exploratie B.V.

- 1991 - Sheffield Exploration - $3,500,000

- Acquisition, through a Joint Venture, of an Interest in the Lignite Gas Processing Plant from OXY USA Inc.

- 1991 - Western Company of North America - $50,000,000

- Public Offering of Common Stock

- 1990 - Apache Corporation - $23,500,000

- Acquisition of Certain Oil and Gas Properties from CNG Producing

- 1990 - ConVest Energy Partners, Ltd.

- Fairness Opinion Regarding Merger with Sandefer Oil Company, L.P. and ConVest Subco Inc., Conversion to Corporation

- 1990 - Gas Compressors, Inc. - $80,000,000

- Sale to First Reserve Corp.

- 1990 - Louis Dreyfus Energy Corporation - $59,000,000

- Acquisition of Bogert Oil Company

- 1990 - Nabors Industries, Inc. - $50,000,000

- Public Offering of Common Stock

- 1990 - Paramount Petroleum - $52,638,000

- Structuring of Paramount 1990 Exploration Programs

- 1990 - Snyder Oil Corporation - $200,000,000

- Merger with Snyder Oil Partners

- 1990 - Sterling Energy

- Acquisition of Oil & Gas Properties from Bridge Oil (USA)

- 1990 - Sterling Energy

- Acquisition of Oil & Gas Properties in Southeastern Utah from Presidio Oil Company, Grace Petroleum Corporation, and Oxford Consolidated Inc.

- 1990 - Western Company of North America - $90,000,000

- Public Offering of 7¼% Convertible Subordinated Debentures

- 1989 - Apache Corporation - $165,000,000

- Standby Underwriter in Redemption of Convertible Subordinated Debentures

- 1989 - Ensource Corporation - $80,000,000

- Advisor to the Special Committee of the Board of Directors of Ensource in its acquisition by United Meridian Corporation

- 1989 - Howell Corporation

- Sale of Certain Oil and Gas Assets

- 1989 - Kirby Corporation - $50,000,000

- Public Offering of 7¼% Convertible Subordinated Debentures

- 1989 - The Louisiana Land & Exploration Company

- Exchange of Certain Oil & Gas Properties with BP Exploration

- 1989 - The Louisiana Land & Exploration Company

- Sale of Oil & Gas Properties to Amerada Hess Corporation

- 1989 - The Louisiana Land & Exploration Company

- Sale of Oil & Gas Properties to Bonneville Fuels Corporation

- 1989 - The Louisiana Land & Exploration Company

- Sale of Oil & Gas Properties to Energy Development Corporation

- 1989 - The Louisiana Land & Exploration Company

- Sale of Oil & Gas Properties to Meridian Oil Holdings Inc.

- 1989 - The Louisiana Land & Exploration Company

- Sale of Oil & Gas Properties to Samedan Oil Corporation

- 1989 - Pacific Enterprises Oil Company (USA)

- Sale of Oil & Gas Properties to BEREDCO, Inc.

- 1989 - Pacific Enterprises Oil Company (USA)

- Sale of Oil & Gas Properties to Black Hawk Oil Company

- 1989 - Pacific Enterprises Oil Company (USA)

- Sale of Oil & Gas Properties to Snyder Oil Company

- 1989 - Snyder Oil Partners - $25,000,000

- Private Placement of Participating Preferred Shares

- 1989 - Union Pacific Resources Company

- Sale of Certain Oil and Gas Assets to Berenergy Corporation

- 1989 - Union Pacific Resources Company

- Sale of Certain Oil and Gas Assets to Swift Energy Company

- 1989 - Wainoco Oil Corporation - $46,000,000

- Public Offering of 7¼% Convertible Subordinated Debentures

- 1988 - Alcoa Aluminum Company - $65,500,000

- Sale of Oil and Gas Properties to Formosa Plastics

- 1988 - Apache Corporation - $200,000,000

- Exchange Offer of Common Stock for MLP Units

- 1988 - BP America Incorporated - $55,000,000

- Sale of Oil and Gas Properties to Presidio Oil Company

- 1988 - Cleveland Cliffs Inc. - $42,000,000

- Spin-off of Cliffs Drilling Company

- 1988 - Flag-Redfern Oil Company - $86,000,000

- Cash Merger with Kerr-McGee Corporation

- 1988 - Kirby Corporation - $65,000,000

- Sale of Oil and Gas Assets of Kirby Exploration Inc. to American Exploration Company

- 1988 - ONEOK - $45,000,000

- Sale of Oil & Gas Properties to Mustang Energy

- 1988 - Pegasus Holding Corporation

- Sale of Oil and Gas Properties to Amerada Hess Corporation

- 1988 - Pegasus Holding Corporation

- Sale of Oil and Gas Properties to Graham Royalty, Ltd.

- 1988 - Pegasus Holding Corporation

- Sale of Oil and Gas Properties to Shell Oil Company

- 1988 - Pegasus Holding Corporation

- Sale of Oil and Gas Properties to Universal Resources Corporation

- 1988 - Sabine Corporation - $339,000,000

- Takeover Defense in Response to an Unsolicited Acquisition Attempt by Presidio Oil Company Followed by a Cash Tender Offer by Pacific Enterprises

- 1988 - Sun Company, Inc.

- Spin-off of Sun Exploration and Production Company

- 1987 - Atlantic Richfield Company

- Sale of 36.5% Interest in the Headlee Devonian Unit to Amoco Corporation

- 1987 - Atlantic Richfield Company

- Sale of Oil and Gas Properties to Hondo Oil & Gas Company

- 1987 - Borden Chemicals and Plastics - $240,000,000

- Public Offering of MLP Units

- 1987 - Cenergy Corporation - $102,000,000

- Takeover Defense Followed by a Merger with Conquest Exploration Company

- 1987 - Diamond Shamrock Corporation - $1,700,000,000

- Takeover Defense in Response to an Unsolicited Takeover Attempt (Offer Unsuccessful) by Mesa Limited Partnership

- 1987 - Diamond Shamrock Corporation - $392,000,000

- Spin-off of Diamond Shamrock Refining and Marketing

- 1987 - Diamond Shamrock Corporation - $340,000,000

- Self-Tender Offer for 20 million shares of Common Stock

- 1987 - Diamond Shamrock Corporation - $300,000,000

- Private Placement of 3 million shares of Preferred Stock to Prudential Insurance Company

- 1987 - Freeport McMoRan Inc. - $150,000,000

- Public Offering of Senior Notes

- 1987 - Marion Corporation

- Sale of Oil and Gas Assets to Santa Fe Energy Resources, Inc.

- 1987 - NRM Energy - $144,000,000

- Offering of MLP Units

- 1987 - PPG Industries, Inc.

- Sale of Michigan Oil and Gas Operation to Marathon Oil Company

- 1987 - Shell Oil Company - $83,000,000

- Acquisition of Oil and Gas Properties from Union Texas Petroleum

- 1987 - The Standard Oil Company - $7,992,000,000

- Purchase for Cash (Tender Offer) and Warrants by The British Petroleum Company, P.L.C.

- 1987 - Union Texas Petroleum - $60,000,000

- Sale of Oil and Gas Properties to American Exploration Company

- 1987 - Valero Natural Gas Partners, L.P. - $216,000,000

- Initial Public Offering of Master Limited Partnership Units

- 1987 - Wainoco Oil Corporation

- Standby Underwriter in Redemption of Warrants to Purchase Common Stock

- 1987 - Wainoco Oil Corporation - $28,000,000

- Public Offering of Units Consisting of Common Stock with Detachable Warrants to Purchase Common Stock

- 1986 - Arkla, Incorporated - $305,000,000

- Acquisition of Mississippi River Transmission Corporation from MidCon Corporation

- 1986 - Ashland Oil Company - $1,800,000,000

- Takeover Defense in Response to an Unsolicited Takeover Attempt (Offer Unsuccessful) by First City Financial Corporation

- 1986 - Atlantic Richfield Company

- Sale of Oil and Gas Properties to Maple Corporation

- 1986 - Freeport-McMoRan Gold Corporation - $40,000,000

- Public Offering of Common Stock

- 1986 - Freeport McMoRan Inc. - $250,000,000

- Cash Tender Offer for American Royalty Trust Units

- 1986 - Freeport McMoRan Resources - $360,000,000

- Public Offerings of MLP Units

- 1986 - Inexco Oil Company - $131,000,000

- Merger for Common Stock with The Louisiana Land & Exploration Company

- 1986 - Mesa Petroleum - $400,000,000

- Public Offering of MLP Units

- 1986 - NL Industries - $910,000,000

- Takeover Defense in Response to an Unsolicited Takeover Attempt (Offer Unsuccessful) by Coniston Partners

- 1986 - Occidental Petroleum Corporation - $3,000,000,000

- Cash Tender Offer Followed by a Common Stock Merger with MidCon Corporation

- 1986 - Petro-Lewis Corporation - $800,000,000

- Sale to Freeport-McMoRan

- 1986 - Santa Fe Energy - $120,000,000

- Public Offering of MLP Units

- 1986 - Sun Company, Inc. - $850,000,000

- Sale of Oil and Gas Properties to Various Purchasers

- 1986 - Texaco Inc.

- Sale of Northeast Pipe Lines and Terminals to The Coastal Corporation

- 1986 - Texas Oil & Gas Corporation - $3,560,000,000

- Merger for Common Stock with United States Steel Corporation

- 1986 - Triton Energy Corporation

- Standby Underwriter in Redemption of $1.10 Convertible Exchangeable Depositary Preferred Stock.

- 1986 - Triton Energy Corporation - $119,000,000

- Public Offerings of Common Stock

- 1986 - Worldwide Energy Corporation - $90,000,000

- Acquisition by Triton Energy Corporation

- 1985 - Adobe Oil & Gas Corporation - $215,000,000

- Merger for Common and Preferred Stock with Madison Resources, Inc.

- 1985 - Allied Corporation - $1,700,000,000

- Sale of 50% Interest in Union Texas Petroleum to Kohlberg Kravis Roberts & Company Investor Group

- 1985 - American Natural Resources - $2,500,000,000

- Cash Tender Offer by The Coastal Corporation

- 1985 - Apache Corporation - $200,000,000

- Private Placement of Limited Recourse Notes

- 1985 - Apache Corporation - $165,000,000

- Public Offerings of Convertible Debentures

- 1985 - ConVest Energy Partners, Ltd. - $87,000,000

- Exchange Offer and Solicitation of Consents for Certain Oil and Gas Properties Formed by ConVest Energy Corporation

- 1985 - Fluor Corporation - $190,000,000

- Sale of Oil and Gas Operations to Houston Industries

- 1985 - Freeport McMoRan Energy - $121,000,000

- Public Offering of MLP Units

- 1985 - Marathon Oil Company - $105,000,000

- Sale of California Properties to Shell Oil Company

- 1985 - May Energy Partners - $33,000,000

- Acquisition of Partnership Interests

- 1985 - Occidental Petroleum Corporation - $30,000,000

- Sale of Lathrop Gas Field to Texas Oil & Gas Corporation

- 1985 - Rayonier Timberland - $100,000,000

- Public Offering of MLP Units

- 1985 - Texaco Inc.

- Sale of 40% Interest in Wyco Pipeline to Mobil Corporation

- 1985 - Texaco Inc. - $95,000,000

- Sale of Northeast Marketing Activities of Getty Oil Company to Power Test Corporation

- 1985 - Texaco Inc. - $43,000,000

- Sale of Eagle Point Refinery Complex to The Coastal Corporation

- 1985 - Triton Energy Corporation

- Disposition of Interests in Sundance Energy Company

- 1985 - Triton Energy Corporation

- Acquisition of Cambridge Energy Company

- 1984 - Consolidated Oil & Gas, Inc. - $45,000,000

- Sale of Oil and Gas Properties to Natural Resources Management Corporation

- 1984 - Equitable Resources, Inc. - $43,000,000

- Merger for Cash with Union Drilling

- 1984 - Howell Corporation - $80,000,000

- Acquisition of Howell Petroleum

- 1984 - Husky Oil Ltd. - $505,000,000

- Sale of Husky Oil Company to Marathon Oil Company

- 1984 - The Louisiana Land & Exploration Company - $97,000,000

- Repurchase of 2,760,000 (9.1%) Shares of Louisiana Land Common Stock from Pioneer Corporation

- 1983 - The Louisiana Land & Exploration Company - $247,000,000

- Spin-off of Louisiana Land Royalty Trust and Proxy Contest (Defeated) with The Louisiana Land Committee for New Management

- 1984 - Snyder Oil Partners - $68,000,000

- Public Offerings of MLP Units

- 1984 - Sundance Oil Company - $106,000,000

- Merger for Cash with Societe Quebecoise d’Initiatives Petrolieres

- 1984 - Texaco Inc. - $10,100,000,000

- Cash Tender Offer for Getty Oil Company

- 1984 - Texas American Energy - $14,000,000

- Public Offering of Convertible Exchangeable Preferred Stock

- 1984 - Triton Energy Corporation - $40,000,000

- Public Offering of Units Consisting of 13% Senior Subordinated Notes with Detachable Warrants to Purchase Common Stock

- 1984 - Triton Energy Corporation - $23,000,000

- Public Offering of $1.10 Convertible Exchangeable Depositary Preferred Stock

- 1984 - Unimar Company - $511,000,000

- Cash Tender Offer/Merger for Indonesian Participating Certificates with ENSTAR Corporation

- 1983 - Apache Offshore - $185,000,000

- Private Placement of Investment Partnership Units

- 1983 - Consolidated Oil & Gas, Inc. - $18,000,000

- Takeover Defense in Response to an Unsolicited Takeover Attempt (Offer Unsuccessful) by The Appalachian Company

- 1983 - CSX Corporation - $1,070,000,000

- Cash Tender Offer for Texas Gas Resources Corporation

- 1983 - General American Oil Company of Texas - $1,142,000,000

- Self-Tender Followed by a Merger for Cash with Phillips Petroleum Company

- 1983 - Global Marine - $100,000,000

- Public Offering of Convertible Exchangeable Preferred Stock

- 1983 - The Louisiana Land & Exploration Company - $247,000,000

- Repurchase of Common Stock for Cash and Notes from Second Crescent Investment Company and American Financial Corporation

- 1983 - Vanderbilt Energy - $30,000,000

- Sale to Madison Energy

- 1983 - Worldwide Energy Corporation - $16,000,000

- Public Offering of Convertible Preferred Stock

- 1982 - Apache Petroleum Company - $445,000,000

- Public Offerings of MLP Units

- 1982 - Conquest Exploration - $200,000,000

- Acquisition of CanAm Partnership Interests

- 1982 - Conquest Exploration - $30,000,000

- Rights Offering of Common Stock and Warrants to Holders of CanAm Limited Partnership Interests

- 1982 - Energy Management - $12,000,000

- Public Offering of Convertible Debentures

- 1982 - Hutton/Apache Energy - $100,000,000

- Private Placements of Income Funds

- 1981 - Apache Corporation - $25,000,000

- Private Placement of Convertible Notes

- 1981 - Apache Petroleum Company - $200,000,000

- Exchange Offer of MLP Units for Partnership Interests

- 1981 - Delta Drilling - $35,000,000

- Initial Public Offering of Common Stock

- 1981 - Ensource Corporation - $500,000,000

- Exchange Offer of Common Stock for Partnership Interests

- 1981 - Texas American Energy - $27,000,000

- Acquisition of Western Kentucky Gas

- 1981 - Verna Drilling - $9,750,000

- Initial Public Offering of Common Stock

- 1980 - American Quasar Petroleum - $30,000,000

- Private Placement of Convertible Notes

- 1980 - Energy Management - $100,000,000

- Acquisition of Partnership Interests

- 1980 - Howell Petroleum - $76,000,000

- Acquisition of Partnership Interests

- 1980 - Ratliff Drilling and Exploration - $20,000,000

- Initial Public Offering of Common Stock

- 1980 - Rio Grande Drilling - $5,200,000

- Initial Public Offering of Common Stock

- 1979 - Fletcher Oil and Refining Co. - $6,000,000

- Private Placement of Pollution Control Bonds

- 1979 - Texas American Oil - $32,000,000

- Public Offering of Common Stock and Subordinated Debt

- 1978 - Tesoro Petroleum - $80,000,000

- Sale of Oil and Gas Properties to Shell Oil, Damson Oil, Norcen Energy, Petro-Lewis and Others

- 1977 - Buttes Gas and Oil - $80,000,000

- Public Offering of Notes with Common Stock

- 1976 - Tesoro Petroleum - $100,000,000

- Acquisition of 37% of the Common Stock of Commonwealth Oil & Refinery Co.

- 1971 - Tesoro Petroleum - $280,000,000

- Public Offerings of Common Stock with Warrants, Convertible Preferred, and Warrant Exercise Exchange

- 1971 - Tesoro Petroleum - $5,000,000

- Private Placement of Convertible Preferred Stock

- 1970 - Tesoro Exploration and Development Program - $35,000,000

- Private Placements

Private Finance & Public Offerings

- 2017 - East Cameron Operating Company

- Financial Advisor on the Purchase of Senior Debt Securities and DIP Loan Funding in Support of East Cameron Operating Company's Reorganization in Chapter 11 Bankruptcy

- 2016 - Primexx Energy Partners, Ltd. - $430,000,000

- Private Placement of Senior Preferred Equity, Replacement of Second Lien Secured Term Loan and Equity Commitment to Fund a Mineral Royalty Trust SPV

- 2015 - Primexx Energy Partners, Ltd. - $125,000,000

- Private Placement of Second Lien Secured Term Loan

- 2013 - Undisclosed Permian Basin Company - $110,000,000

- Private Placement of First Lien ($40,000,000), Second Lien Term Loan with Warrants ($60,000,000) and Follow-On Equity ($10,000,000)

- 2012 - Monterey Energy - $6,400,000

- Private Placement

- 2011 - Hi-Crush Proppants LLC - $70,000,000

- Private Placement

- 2011 - LasRosas Capital LLC & RGW Interests LLC

- Formation of Eagle Ford Shale Participation Agreement with Liberty Energy

- 2011 - Ultra Tech Frac Services, LLC - $21,250,000

- Private Placement

- 2008 - Royal Offshore, LLC - $350,000,000

- Private Placement with Encap Investments and Avista Capital to Pursue Gulf of Mexico Exploration Program

- 2007 - Patriot Resources Partners LLC

- Private Placement

- 2006 - Halliburton

- Private Placement for Formation of Red Technology Alliance

- 2006 - Wapiti

- Private Placement

- 2004 - Mission Resources Corporation - $155,000,000

- Private Offering of a Second Lien Term Loan and 9 7/8% Senior Notes due 2011

- 1997 - Santa Fe Energy Corporation - $854,000,000

- Spin-Off of Monterey Resources

- 1996 - Amerac Energy - $6,000,000

- Private Placement of Common Stock with Warrants and Exploitation Program

- 1996 - Enron Corporation - $200,000,000

- Public Offering of 8.30% Trust Originated Preferred Securities (“TOPrS”)

- 1996 - Gulfstream Resources, Inc. - $77,000,000

- Sale of Stock to Burlington Resources, Inc.

- 1994 - Petroleum Geo-Services A/S - $72,000,000

- Public Offering of American Depositary Receipts

- 1994 - Pogo Producing Company - $86,000,000

- Public Offering of 5½% Convertible Subordinated Debentures

- 1994 - Santa Fe Energy Resources, Inc.

- Public Offering of $8.875 Delayed Equity Convertible Securities (“DECS”)

- 1993 - Enron Oil & Gas Company - $117,000,000

- Public Offering of Common Stock

- 1993 - Global Industries Ltd. - $38,000,000

- Initial Public Offering of Common Stock

- 1993 - The Louisiana Land & Exploration Company

- Public Offering of 7.65% Debentures

- 1993 - The Louisiana Land & Exploration Company - $196,000,000

- Public Offering of Common Stock

- 1993 - Petroleum Geo-Services A/S - $73,000,000

- Public Offering of American Depositary Receipts

- 1993 - Noble Affiliates, Inc. - $230,000,000

- Public Offering of 4¼% Convertible Subordinated Debentures

- 1993 - Noble Affiliates, Inc. - $152,000,000

- Public Offering of Common Stock

- 1993 - Sonat Offshore Drilling - $373,000,000

- Initial Public Offering of Common Stock

- 1992 - Apache Corporation - $75,000,000

- Private Placement of 3.93% Convertible Select Premium Low Interest Trust Securities (“SPLITS”)

- 1992 - Santa Fe Energy Resources, Inc. - $126,000,000

- Public Offering Secure Principal Energy Receipts (“SPERS”) of Santa Fe Energy Trust

- 1991 - Moorco International Inc. - $104,000,000

- Initial Public Offering of Common Stock

- 1991 - Western Company of North America - $50,000,000

- Public Offering of Common Stock

- 1990 - Nabors Industries, Inc. - $50,000,000

- Public Offering of Common Stock

- 1990 - Western Company of North America - $90,000,000

- Public Offering of 7¼% Convertible Subordinated Debentures

- 1989 - Apache Corporation - $165,000,000

- Standby Underwriter in Redemption of Convertible Subordinated Debentures

- 1989 - Kirby Corporation - $50,000,000

- Public Offering of 7¼% Convertible Subordinated Debentures

- 1989 - Snyder Oil Partners - $25,000,000

- Private Placement of Participating Preferred Shares

- 1989 - Wainoco Oil Corporation - $46,000,000

- Public Offering of 7¼% Convertible Subordinated Debentures

- 1988 - Apache Corporation - $200,000,000

- Exchange Offer of Common Stock for MLP Units

- 1987 - Borden Chemicals and Plastics - $240,000,000

- Public Offering of MLP Units

- 1987 - Diamond Shamrock Corporation - $300,000,000

- Private Placement of 3 million shares of Preferred Stock to Prudential Insurance Company

- 1987 - Freeport McMoRan Inc. - $150,000,000

- Public Offering of Senior Notes

- 1987 - NRM Energy - $144,000,000

- Offering of MLP Units

- 1987 - The Standard Oil Company - $7,992,000,000

- Purchase for Cash (Tender Offer) and Warrants by The British Petroleum Company, P.L.C.

- 1987 - Valero Natural Gas Partners, L.P. - $216,000,000

- Initial Public Offering of MLP Units

- 1987 - Wainoco Oil Corporation

- Standby Underwriter in Redemption of Warrants to Purchase Common Stock

- 1987 - Wainoco Oil Corporation - $28,000,000

- Public Offering of Units Consisting of Common Stock with Detachable Warrants to Purchase Common Stock

- 1986 - Freeport-McMoRan Gold Corporation - $40,000,000

- Public Offering of Common Stock

- 1986 - Freeport-McMoRan Resources - $360,000,000

- Public Offering of MLP Units

- 1986 - Mesa Petroleum - $400,000,000

- Public Offering of MLP Units

- 1986 - Santa Fe Energy - $120,000,000

- Public Offering of MLP Units

- 1986 - Triton Energy Corporation

- Standby Underwriter in Redemption of $1.10 Convertible Exchangeable Depositary Preferred Stock

- 1986 - Triton Energy Corporation - $119,000,000

- Public Offering of Common Stock

- 1985 - Apache Corporation - $165,000,000

- Public Offering of Convertible Debentures

- 1985 - Apache Corporation - $200,000,000

- Private Placement of Limited Recourse Notes

- 1985 - Freeport McMoRan Energy - $121,000,000

- Public Offering of MLP Units

- 1985 - Rayonier Timberland - $100,000,000

- Public Offering of MLP Units

- 1984 - Snyder Oil Partners - $68,000,000

- Public Offering of MLP Units

- 1984 - Texaco Inc. - $10,100,000,000

- Cash Tender Offer for Getty Oil Company

- 1984 - Texas American Energy - $14,000,000

- Public Offering of Convertible Exchangeable Preferred Stock

- 1984 - Triton Energy Corporation - $40,000,000

- Public Offering of Units Consisting of 13% Senior Subordinated Notes with Detachable Warrants to Purchase Common Stock

- 1984 - Triton Energy Corporation - $23,000,000

- Public Offering of $1.10 Convertible Exchangeable Depositary Preferred Stock

- 1983 - Apache Offshore - $185,000,000

- Private Placement of Investment Partnership Units

- 1983 - Global Marine - $100,000,000

- Public Offering of Convertible Exchangeable Preferred Stock

- 1983 - Worldwide Energy Corporation - $16,000,000

- Public Offering of Convertible Preferred Stock

- 1982 - Apache Petroleum Company - $445,000,000

- Public Offering of MLP Units

- 1982 - Conquest Exploration - $30,000,000

- Rights Offering of Common Stock and Warrants to Holders of CanAm Limited Partnership Interests

- 1982 - Energy Management - $12,000,000

- Public Offering of Convertible Debentures

- 1982 - Hutton/Apache Energy - $100,000,000

- Private Placements of Income Funds

- 1981 - Apache Corporation - $25,000,000

- Private Placement of Convertible Notes

- 1981 - Delta Drilling - $35,000,000

- Initial Public Offering of Common Stock

- 1981 - Verna Drilling - $9,750,000

- Initial Public Offering of Common Stock

- 1980 - American Quasar Petroleum - $30,000,000

- Private Placement of Convertible Notes

- 1980 - Ratliff Drilling and Exploration - $20,000,000

- Initial Public Offering of Common Stock

- 1980 - Rio Grande Drilling - $5,200,000

- Initial Public Offering of Common Stock

- 1979 - Fletcher Oil and Refining Co. - $6,000,000

- Private Placement of Pollution Control Bonds

- 1979 - Texas American Oil - $32,000,000

- Public Offering of Common Stock and Subordinated Debt

- 1977 - Buttes Gas and Oil - $80,000,000

- Public Offering of Notes with Common Stock

- 1971 - Tesoro Petroleum - $5,000,000

- Private Placement of Convertible Preferred Stock

- 1971 - Tesoro Petroleum - $280,000,000

- Public Offering of Common Stock with Warrants, Convertible Preferred and Warrant Exercise Exchange

- 1970 - Tesoro Exploration and Development Program - $35,000,000

- Private Placement

Strategic Advisory & Fairness Opinions

- 2019 - Bravo Natural Resources

- Financial Advisor in Connection with Identifying and Evaluating Acquisition Opportunities

- 2012 - 2017 - Monterey Energy LLC

- Served as Financial Advisor on Corporate Matters

- 2016 - Caza Oil and Gas, Inc.

- Formal Valuation to the Special Committee Regarding Going-Private Transaction

- 2016 - Primexx Energy Partners, Ltd. - $430,000,000

- Private Placement of Senior Preferred Equity, Replacement of Second Lien Secured Term Loan and Equity Commitment to Fund a Mineral Royalty Trust SPV

- 2016 - Undisclosed Private Company

- Financial Advisor in Connection with Identifying and Evaluating Strategic Alternatives

- 2015 - Undisclosed Permian Basin Company

- Restructuring of Second Lien Term Loan

- 2015 - Undisclosed Private Company

- Served Board of Directors to Advise Company on Value for Purposes of New Equity Options Issuance

- 2012 - 2014 - Ultra Tech Frac Services, LLC

- Served as Financial Advisor on Corporate Matters

- 2014 - Undisclosed Private Company

- Served Board of Directors to Advise Company on Value for Purposes of New Equity Options Issuance

- 2013 - Undisclosed Private Company

- Financial Advisor to the Advisory Board of a Private Company in Connection with the Sale of its Assets to Constellation Energy Partners

- 2013 - Undisclosed Private Company

- Served Board of Directors to Advise Company on Value for Purposes of New Equity Options Issuance

- 2013 - Undisclosed Private Company

- Advisor to Board of Directors to Provide Certain Financial Advisory Services

- 2012 - Dune Energy, Inc.

- Strategic Advisory in Connection with Identifying and Evaluating Strategic and Financial Alternatives

- 2011 - Cinco Resources

- Fairness Opinion to Special Committee Regarding Merger with Cima Resources

- 2011 - Dune Energy, Inc.

- Fairness Opinion Regarding Debt Exchange Offer

- 2011 - MatlinPatterson

- Acquisition of a Controlling Stake in Stone Mountain Resources

- 2010 - Undisclosed Private Company

- Served Board of Directors to Advise Company on Value for Purposes of New Equity Options Issuance

- 2009 - Beryl Oil and Gas LP

- Financial Advisor to First Lien Creditors in sale of Beryl to Dynamic Offshore Resources

- 2009 - Energy Partners Ltd. - $520,000,000

- Reorganization under Chapter 11 Bankruptcy Code pursuant to Debt-for-Equity Exchange and Exit Financing

- 2009 - Quicksilver Gas Services LP - $87,100,000

- Fairness Opinion to Conflicts Committee of Board of Directors on its Drop-Down Acquisition of Alliance Midstream Assets from Quicksilver Resources

- 2006 - Halliburton

- Private Placement for Formation of Red Technology Alliance

- 2005 - Southern California Power Producers Authority - $300,000,000

- Purchase of Wyoming Producing Gas Properties from Anschutz Pinedale Corporation

- 2004 - First International Oil Company - $160,000,000

- Fairness Opinion on Sale of Kazakhstan assets to Sinopec

- 2004 - Houston Exploration

- “KeySpan Exchange Transactions” where HE contributed Subsidiary Seneca-Upshur Petroleum Inc. Assets and $389,000,000 Cash in exchange for 10,800,000 Shares of HE Common Stock Owned by KeySpan

- 2003 - Sacramento Municipal Utility District

- Purchase of Gas Assets from El Paso Corp.

- 2002 - NIKOIL

- Fairness Opinion on Minority Takeout of Lukoil Baltija Shares

- 2001 - First Wave Marine

- Financial Advisor to the Official Committee of Unsecured Creditors in this Chapter 11 Bankruptcy Case

- 2001 - International Paper Company - $300,000,000

- Conveyance of its Subsidiary IP Petroleum Company, Inc. to Pure Resources, Inc.

- 2001 - Kingdom of Saudi Arabia

- Advisory Assignment to Design Integrated Natural Gas Projects for Direct Foreign Investment

- 1999 - The Wiser Oil Company - $25,000,000

- Fairness Opinion Regarding Private Placement of Convertible Preferred Stock

- 1998 - Vastar Resources, Inc. - $470,000,000

- Acquisition of Western Midway Company from Atlantic Richfield Company in Three-Company Transaction Involving Vastar, ARCO, and Mobil

- 1997 - Amoco Production Company - $1,000,000,000

- Formation of a Joint Venture with Maxus Energy Corporation

- 1995 - ConVest Energy Corporation - $20,100,000

- Fairness Opinion Regarding the Acquisition of Edisto Exploration and Production Company

- 1994 - Bridge Oil Ltd. - $272,400,000

- Valuation Opinion Regarding the U.S. Oil & Gas Assets of Bridge Oil Ltd. in Response to an Unsolicited Offer from Parker & Parsley

- 1994 - Edisto Resources - $72,000,000

- Fairness Opinion Regarding the Sale of Pipeline and Distribution Assets to Aquila

- 1992 - Hondo Oil and Gas Company - $140,000,000

- Fairness Opinion Regarding Sale of Substantially all of its Domestic Oil & Gas Properties to Devon Energy Corporation

- 1991 - Cross Timbers Partners, L.P.

- Fairness Opinion Regarding the Roll-up of Five Limited Partnerships into Cross Timbers Oil Company, L.P. and Cross Timbers Royalty Trust

- 1990 - ConVest Energy Partners, Ltd.

- Fairness Opinion Regarding Merger with Sandefer Oil Company, L.P. and ConVest Subco Inc., Conversion to Corporation

- 1989 - Ensource Corporation - $80,000,000

- Advisor to the Special Committee of the Board of Directors of Ensource in its acquisition by United Meridian Corporation

- 1988 - Cleveland Cliffs Inc. - $42,000,000

- Spin-off of Cliffs Drilling Company

- 1987 - Diamond Shamrock Corporation - $392,000,000

- Spin-off of Diamond Shamrock Refining and Marketing

- 1986 - NL Industries - $910,000,000

- Takeover Defense in Response to an Unsolicited Takeover Attempt (Offer Unsuccessful) by Coniston Partners

- 1985 - Allied Corporation - $1,700,000,000

- Sale of 50% Interest in Union Texas Petroleum to Kohlberg Kravis Roberts & Company Investor Group

- 1984 - The Louisiana Land & Exploration Company - $97,000,000

- Repurchase of 2,760,000 (9.1%) Shares of Louisiana Land Common Stock from Pioneer Corporation

- 1983 - Consolidated Oil & Gas, Inc. - $18,000,000

- Takeover Defense in Response to an Unsolicited Takeover Attempt (Offer Unsuccessful) by The Appalachian Company

- 1983 - The Louisiana Land & Exploration Company - $247,000,000

- Repurchase of Common Stock for Cash and Notes from Second Crescent Investment Company and American Financial Corporation

Mergers & Acquisitions

- 2013 - Ultra Tech Frac Services, LLC

- Sale to Keane Group

- 2013 - Undisclosed Private Company

- Financial Advisor to the Advisory Board of a Private Company in Connection with the Sale of its Assets to Constellation Energy Partners

- 2011 - MatlinPatterson

- Acquisition of a Controlling Stake in Stone Mountain Resources

- 2008 - Mark West Energy Partners - $3,000,000,000

- Merger with Mark West Hydrocarbon, Inc.

- 2006 - Chief Oil and Gas - $2,200,000,000

- Sale of Company to Devon Energy

- 2005 - Latigo Petroleum - $750,000,000

- Company Sale to Pogo Producing

- 2005 - Southern California Power Producers Authority - $300,000,000

- Purchase of Wyoming Producing Gas Properties from Anschutz Pinedale Corporation

- 2005 - USX Exploration - $350,000,000

- Company Sale to Noble Energy

- 2004 - Houston Exploration - $449,000,000

- “KeySpan Exchange Transactions” where HE contributed Subsidiary Seneca-Upshur Petroleum Inc. Assets and $389,000,000 Cash in exchange for 10,800,000 Shares of HE Common Stock Owned by KeySpan

- 2004 - Patina Oil & Gas - $3,400,000,000

- Merger with Noble Energy

- 2004 - Plains Resources - $466,700,000

- Merger with Vulcan Capital Management

- 2003 - Sacramento Municipal Utility District

- Purchase of gas assets from El Paso Corp.

- 2002 - Pure Resources - $1,800,000,000

- Merger with Unocal Corporation

- 2001 - Barrett Resources Corporation - $2,900,000,000

- Merger with the Williams Companies

- 2001 - Cody Company - $230,000,000

- Merger with Cabot Oil & Gas

- 2001 - Hallwood Energy Corporation - $268,000,000

- Merger with Pure Resources, Inc.

- 2001 - International Paper Company - $300,000,000

- Conveyance of its Subsidiary IP Petroleum Company, Inc. to Pure Resources, Inc.

- 2000 - Costilla Energy - $133,300,000

- Advisor to Debtor in Chapter 11 363 Sale of Certain Assets to Louis Dreyfus Natural Gas

- 2000 - Forcenergy Inc. - $936,000,000

- Merger with Forest Oil Corporation

- 2000 - Southern Mineral Corporation - $80,000,000

- Merger with PetroCorp Inc.

- 2000 - Vastar Resources, Inc. - $9,061,000,000

- Merger into Atlantic Richfield Company / BP Amoco

- 1999 - Atlantic Richfield Company - $100,000,000

- Divestiture of ARCO Long Beach, Inc. to Occidental Petroleum Corporation

- 1999 - K N Energy, Inc. - $978,000,000

- Merger with Kinder Morgan Energy, Inc.

- 1999 - Snyder Oil Corporation - $600,000,000

- Merger with Santa Fe Energy Corporation

- 1999 - Titan Exploration, Inc. - $217,400,000

- Merger with Unocal’s Permian Basin Business Unit to form Pure Energy Resources, Inc.

- 1998 - Amerac Energy - $24,000,000

- Sale of the Company to Southern Minerals

- 1998 - Domain Energy - $250,000,000

- Sale to Range Resources

- 1998 - Hugoton Energy Corporation - $380,000,000

- Merger with Chesapeake Energy Corporation

- 1998 - Union Texas Petroleum Holdings - $3,539,000,000

- Merger into Atlantic Richfield Company

- 1998 - Vastar Resources, Inc. - $470,000,000

- Acquisition of Western Midway Company from Atlantic Richfield Company in three-company transaction involving Vastar, ARCO, and Mobil

- 1997 - Amoco Production Company - $1,000,000,000

- Formation of a Joint Venture with Maxus Energy Corporation

- 1997 - Coda Energy - $334,000,000

- Merger with Belco Oil and Gas

- 1997 - ConVest Energy Corporation/Edisto Resources Corporation - $172,000,000

- Merger with Forcenergy Inc.

- 1997 - Department of Energy - $3,650,000,000

- Asset Sale of Elk Hills to Occidental Petroleum

- 1997 - Monterey Resources - $106,000,000

- Acquisition of McFarland Energy

- 1997 - Republic Gas Partners L.L.C. - $29,500,000

- Merger with MidCoast Energy Resources, Inc.

- 1997 - Santa Fe Energy Corporation - $854,000,000

- Spin-Off of Monterey Resources

- 1997 - Western Mining Corporation - $270,000,000

- Sale of Its U.S. Subsidiary, Greenhill Petroleum Corporation, to MESA Inc.

- 1996 - Global Natural Resource Inc. - $531,000,000

- Merger with Seagull Energy Corporation

- 1996 - Sheffield Exploration

- Merger with TransMontaigne Oil Company

- 1996 - The Phoenix Resource Companies, Inc. - $406,000,000

- Merger with Apache Corp.

- 1995 - Barrett Resources Corporation - $321,500,000

- Merger with Plains Petroleum Company

- 1995 - Consolidated Oil & Gas, Inc. - $120,200,000

- Merger with Hugoton Energy Corporation

- 1995 - Patrick Petroleum Company - $28,000,000

- Merger with La/Cal Energy Partners into Goodrich Petroleum Corporation

- 1995 - Reunion Resources Company - $11,600,000

- Sale of 1,450,000 Shares of Common Stock held by Parkdale Holdings Corporation, N.V. to Chatwins Group, Inc.

- 1994 - General Atlantic Resources Corporation - $195,900,000

- Merger with United Meridian

- 1994 - K N Energy, Inc. - $430,270,296

- Merger with American Oil & Gas Corporation

- 1994 - The Wiser Oil Company - $52,000,000

- Acquisition of Canadian Oil & Gas Properties from Eagle Resources, Ltd.

- 1993 - Highway Pipeline Corporation - $4,000,000

- Sale to Edge Group

- 1993 - Kirby Corporation - $24,000,000

- Acquisition of TPT Marine Barge Division of Ashland, Inc.

- 1993 - Kirby Corporation - $50,000,000

- Standby Underwriter in Redemption of 7¼% Convertible Subordinated Debentures

- 1993 - NERCO, Inc. - $1,200,000,000

- Sale to Kennecott

- 1993 - Star Gas Corporation - $120,000,000

- Sale to Petroleum Heat and Power Co.

- 1993 - The Wiser Oil Company - $58,800,000

- Acquisition of Oil & Gas Properties from Mobil Exploration & Production U.S. Inc.

- 1992 - American Exploration Company

- Acquisition of an Additional Interest in Canadian Conquest Exploration from The Prudential Life Insurance Corporation

- 1991 - American Exploration Company - $165,000,000

- Acquisition of Conquest Exploration Company

- 1991 - Apache Corporation - $550,000,000

- Acquisition of MW Petroleum Corporation from Amoco Production Company

- 1991 - Pacific Enterprises Oil Company - $50,000,000

- Sale of Pacific Enterprises Oil Company (Netherlands) to Petron Exploratie B.V.

- 1991 - Sheffield Exploration - $3,500,000

- Acquisition, through a Joint Venture, of an Interest in the Lignite Gas Processing Plant from OXY USA Inc.

- 1990 - Apache Corporation - $23,500,000

- Acquisition of Certain Oil and Gas Properties from CNG Producing

- 1990 - Gas Compressors, Inc. - $80,000,000

- Sale to First Reserve Corp.

- 1990 - Louis Dreyfus Energy Corporation - $59,000,000

- Acquisition of Bogert Oil Company

- 1990 - Paramount Petroleum - $52,638,000

- Structuring of Paramount 1990 Exploration Programs

- 1990 - Snyder Oil Corporation - $200,000,000

- Merger with Snyder Oil Partners

- 1990 - Sterling Energy

- Acquisition of Oil & Gas Properties from Bridge Oil (USA)

- 1990 - Sterling Energy

- Acquisition of Oil & Gas Properties in Southeastern Utah from Presidio Oil Company, Grace Petroleum Corporation, and Oxford Consolidated Inc.

- 1988 - Flag-Redfern Oil Company - $86,000,000

- Cash Merger with Kerr-McGee Corporation

- 1988 - Sabine Corporation - $339,000,000

- Takeover Defense in Response to an Unsolicited Acquisition Attempt by Presidio Oil Company Followed by a Cash Tender Offer by Pacific Enterprises

- 1987 - Cenergy Corporation - $102,000,000

- Takeover Defense Followed by a Merger with Conquest Exploration Company

- 1987 - Diamond Shamrock Corporation - $300,000,000

- Private Placement of 3 million shares of Preferred Stock to Prudential Insurance Company

- 1987 - Diamond Shamrock Corporation - $340,000,000

- Self-Tender Offer for 20 million shares of Common Stock

- 1987 - Diamond Shamrock Corporation - $392,000,000

- Spin-off of Diamond Shamrock Refining and Marketing

- 1987 - Diamond Shamrock Corporation - $1,700,000,000

- Takeover Defense in Response to an Unsolicited Takeover Attempt (Offer Unsuccessful) by Mesa Limited Partnership

- 1987 - Shell Oil Company - $83,000,000

- Acquisition of Oil and Gas Properties from Union Texas Petroleum

- 1987 - The Standard Oil Company - $7,992,000,000

- Purchase for Cash (Tender Offer) and Warrants by The British Petroleum Company, P.L.C.

- 1986 - Arkla, Incorporated - $305,000,000

- Acquisition of Mississippi River Transmission Corporation from MidCon Corporation

- 1986 - Ashland Oil Company - $1,800,000,000

- Takeover Defense in Response to an Unsolicited Takeover Attempt (Offer Unsuccessful) by First City Financial Corporation

- 1986 - Freeport McMoRan Inc. - $250,000,000

- Cash Tender Offer for American Royalty Trust Units

- 1986 - Inexco Oil Company - $131,000,000

- Merger for Common Stock with The Louisiana Land & Exploration Company

- 1986 - Occidental Petroleum Corporation - $3,000,000,000

- Cash Tender Offer Followed by a Common Stock Merger with MidCon Corporation

- 1986 - Petro-Lewis Corporation - $800,000,000

- Sale to Freeport-McMoRan

- 1986 - Texas Oil & Gas Corporation - $3,560,000,000

- Merger for Common Stock with United States Steel Corporation

- 1986 - Worldwide Energy Corporation - $90,000,000

- Acquisition by Triton Energy Corporation

- 1985 - Adobe Oil & Gas Corporation - $215,000,000

- Merger for Common and Preferred Stock with Madison Resources, Inc.

- 1985 - American Natural Resources - $2,500,000,000

- Cash Tender Offer by The Coastal Corporation

- 1985 - ConVest Energy Partners, Ltd. - $87,000,000

- Exchange Offer and Solicitation of Consents for Certain Oil and Gas Properties Formed by ConVest Energy Corporation

- 1985 - May Energy Partners - $33,000,000

- Acquisition of Partnership Interests

- 1985 - Triton Energy Corporation

- Acquisition of Cambridge Energy Company

- 1984 - Equitable Resources, Inc. - $43,000,000

- Merger for Cash with Union Drilling

- 1984 - Howell Corporation - $80,000,000

- Acquisition of Howell Petroleum

- 1984 - Husky Oil Ltd. - $505,000,000

- Sale of Husky Oil Company to Marathon Oil Company

- 1984 - Sundance Oil Company - $106,000,000

- Merger for Cash with Societe Quebecoise d’Initiatives Petrolieres

- 1984 - Texaco Inc. - $10,100,000,000

- Cash Tender Offer for Getty Oil Company

- 1984 - Unimar Company - $511,000,000

- Cash Tender Offer/Merger for Indonesian Participating Certificates with ENSTAR Corporation

- 1983 - CSX Corporation - $1,070,000,000

- Cash Tender Offer for Texas Gas Resources Corporation

- 1983 - General American Oil Company of Texas - $1,142,000,000

- Self-Tender Followed by a Merger for Cash with Phillips Petroleum Company

- 1983 - Vanderbilt Energy - $30,000,000

- Sale to Madison Energy

- 1982 - Conquest Exploration - $200,000,000

- Acquisition of CanAm Partnership Interests

- 1981 - Apache Petroleum Company - $200,000,000

- Exchange Offer of MLP Units for Partnership Interests

- 1981 - Ensource Corporation - $500,000,000

- Exchange Offer of Common Stock for Partnership Interests

- 1981 - Texas American Energy - $27,000,000

- Acquisition of Western Kentucky Gas

- 1980 - Energy Management - $100,000,000

- Acquisition of Partnership Interests

- 1980 - Howell Petroleum - $76,000,000

- Acquisition of Partnership Interests

- 1976 - Tesoro Petroleum - $100,000,000

- Acquisition of 37% of the Common Stock of Commonwealth Oil & Refinery Co.

Divestitures

- 2021 - Undisclosed Seller

- Sale of Certain Permian Assets to Undisclosed Buyer

- 2019 - Jetta Operating Company

- Sale of Certain Texas Gulf Coast Assets to Undisclosed Buyer

- 2017 - Badlands Energy, Inc.

- Sale of Oil and Gas Properties Pursuant to Section 363 of U.S. Bankruptcy Code

- 2017 - Northstar Offshore Group

- Sale of Oil and Gas Properties Pursuant to Section 363 of U.S. Bankruptcy Code

- 2016 - Linc USA GP

- Sale of Oil and Gas Properties Pursuant to Section 363 of U.S. Bankruptcy Code

- 2016 - RAAM Global Energy

- Sale of Oil and Gas Properties Pursuant to Section 363 of U.S. Bankruptcy Code

- 2015 - Dune Energy, Inc.

- Sale of Oil and Gas Properties Pursuant to Section 363 of U.S. Bankruptcy Code

- 2015 - Longview Energy Company

- Sale of Certain California Properties to White Knight Production LLC

- 2011 - Cortez Resources

- Sale of Certain Eagle Ford Shale Assets to Carrizo Oil & Gas

- 2011 - Cortez Resources

- Sale of Certain Eagle Ford Shale Assets to Comstock Resources

- 2011 - Cortez Resources

- Sale of Certain Eagle Ford Shale Assets to Undisclosed Buyer

- 2011 - Cortez Resources and Sierra Buckeye

- Sale of Certain Eagle Ford Shale Assets to Chesapeake Energy

- 2011 - Cortez Resources and Sierra Resources, LLC

- Sale of Certain Eagle Ford Shale Assets to Riley-Huff Energy Group, LLC

- 2011 - The Diocese of Wheeling-Charleston

- Sale of Leases for West Texas Mineral Rights

- 2011 - GHK Exploration (Texas) LLC

- Sale of Eagle Ford Shale Assets to Marathon Oil Corporation

- 2010 - Bigler LP (Bigler Chemical, LP)

- Sale of Basic Liquid Inorganic and Organic Chemicals Marketing subsidiary to Shieve Chemical Company Pursuant to Section 363 of U.S. Bankruptcy Code

- 2010 - Bigler LP (Bigler Land LLC)

- Sale to Intercontinental Terminals Company Pursuant to Section 363 of U.S. Bankruptcy Code

- 2010 - Bigler LP (Bigler Specialty Oils)

- Sale of Technical Mineral Oils, FDA White Oils, and High Purity Hydrocarbon Solvents Marketing subsidiary to Resolute Oil, LLC Pursuant to Section 363 of U.S. Bankruptcy Code

- 2010 - Bigler LP (Bigler Terminals, LP & Bigler Petrochemical, LP)

- Sale of its Tank Leasing & Logistics Services and Isobutylene Manufacturing subsidiaries to Enterprise Products Operating LLC Pursuant to Section 363 of U.S. Bankruptcy Code

- 2010 - Clearwater Natural Resources

- Sale of Substantially All Assets as well as the Assumption of All Reclamation Liabilities by International Resource Partners LP as Part of a Chapter 11 Plan of Reorganization

- 2010 - Cortez Resources

- Sale of Certain Eagle Ford Shale Assets to Penn Virginia Oil & Gas, L.P.

- 2010 - Edge Petroleum Corporation - $260,000,000

- Sale of all Subsidiaries and Operations to Mariner Energy Pursuant to the U.S. Bankruptcy Code

- 2010 - Patriot Resources Partners LLC

- Sale of Oil and Gas Properties to Linn Energy and Rising Star Energy

- 2008 - T-Rex Companies

- Sale of All Permian Basin Oil & Gas Assets to Enervest Energy Institutional Fund XI

- 2006 - Chief Holdings LLC - $480,000,000

- Sale of Midstream Assets to Crosstex Energy LLP

- 2006 - Chief Oil and Gas - $2,200,000,000

- Sale of Company to Devon Energy

- 2005 - Latigo Petroleum - $750,000,000

- Company Sale to Pogo Producing

- 2004 - Bravo Natural Resources - $335,000,000

- Sale of Mid-Con Assets to Chesapeake Energy

- 2004 - Encana Corporation - $2,000,000,000

- Sale of Deepwater Gulf of Mexico Assets to Statoil

- 2003 - El Paso E&P - $752,000,000

- Sale of Assets in Gulf of Mexico, South Texas, ArkLaTex, MidCon and the Rockies

- 2002 - Bravo Natural Resources - $119,000,000

- Sale of Mid-Con Assets to Patina Oil & Gas

- 2001 - International Paper Company - $300,000,000

- Conveyance of its Subsidiary IP Petroleum Company, Inc. to Pure Resources, Inc.

- 2000 - Collins & Ware, Inc. - $68,500,000

- Asset Sale to Apache Corp.

- 2000 - Costilla Energy - $133,300,000

- Advisor to Debtor in Chapter 11 363 Sale of Certain Assets to Louis Dreyfus Natural Gas

- 2000 - Crescendo Resources, L.P.

- Sale of Mid-Con Assets to Apache Corp.

- 2000 - Texaco Inc. - $450,000,000

- Asset Sale to Various Companies

- 1999 - Atlantic Richfield Company - $100,000,000

- Divestiture of ARCO Long Beach, Inc. to Occidental Petroleum Corporation

- 1999 - Petsec Energy - $68,500,000

- Asset Sale to Apache Corp.

- 1999 - Titan Exploration, Inc. - $71,300,000

- Sale of Gulf of Mexico assets to Coastal Oil & Gas Corporation

- 1999 - The Wiser Oil Company - $28,000,000

- Divestiture of certain Appalachian Properties to Columbia Natural Resources

- 1998 - Duer Wagner & Company - $40,500,000